Price Floor Price Ceiling Quizlet

Surplus of 20 units.

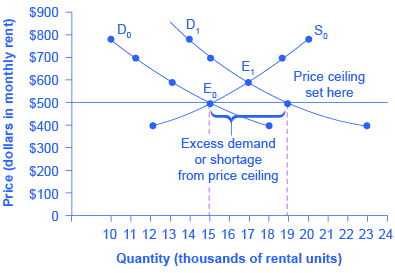

Price floor price ceiling quizlet. The effect of government interventions on surplus. Learn vocabulary terms and more with flashcards games and other study tools. When the ceiling is set below the market price there will be excess demand or a supply shortage. Shortage of 0 units.

Surplus of 40 units. If the price is not permitted to rise the quantity supplied remains at 15 000. Start studying price floors and price ceilings. Shortage of 50 units.

Final exam ch. It is legal minimum price set by the government on particular goods and services in order to prevent producers from being paid very less price. Like price ceiling price floor is also a measure of price control imposed by the government. Producers won t produce as much at the lower price while consumers will demand more because the goods are cheaper.

If a price ceiling were set at 12 there would be a. Price ceilings and price floors. Price ceiling refer to the figure. In this case there is no effect on anything and the equilibrium price and quantity stay the same.

This is the currently selected item. Two things can happen when a price floor is implemented. Price ceilings only become a problem when they are set below the market equilibrium price. The original intersection of demand and supply occurs at e 0 if demand shifts from d 0 to d 1 the new equilibrium would be at e 1 unless a price ceiling prevents the price from rising.

Learn vocabulary terms and more with flashcards games and other study tools. Choose from 500 different sets of price floor flashcards on quizlet. Taxation and dead weight loss. But this is a control or limit on how low a price can be charged for any commodity.

Price floors and price ceilings. Learn vocabulary terms and more with flashcards games and other study tools. A government law that makes it illegal to charger lower than the specified price. Start studying economics 4.

Learn price floor with free interactive flashcards. Percentage tax on hamburgers. Taxes and perfectly inelastic demand. Example breaking down tax incidence.